Where the 2025 Housing Market Is Headed (And What It Means for You)

Can you believe we’re already halfway through 2025?

As we head into the second half of the year, a lot of buyers and sellers are asking the same thing: What’s next for the housing market?

While no forecast is guaranteed, economists from Fannie Mae, Zillow, NAR, MBA, and others have released updated projections on everything from home prices and mortgage rates to sales activity and market recovery.

In this post, I’ve rounded up the key takeaways from their mid-year outlooks—and added a breakdown of what they could mean for our local market here in [❗YOUR AREA].

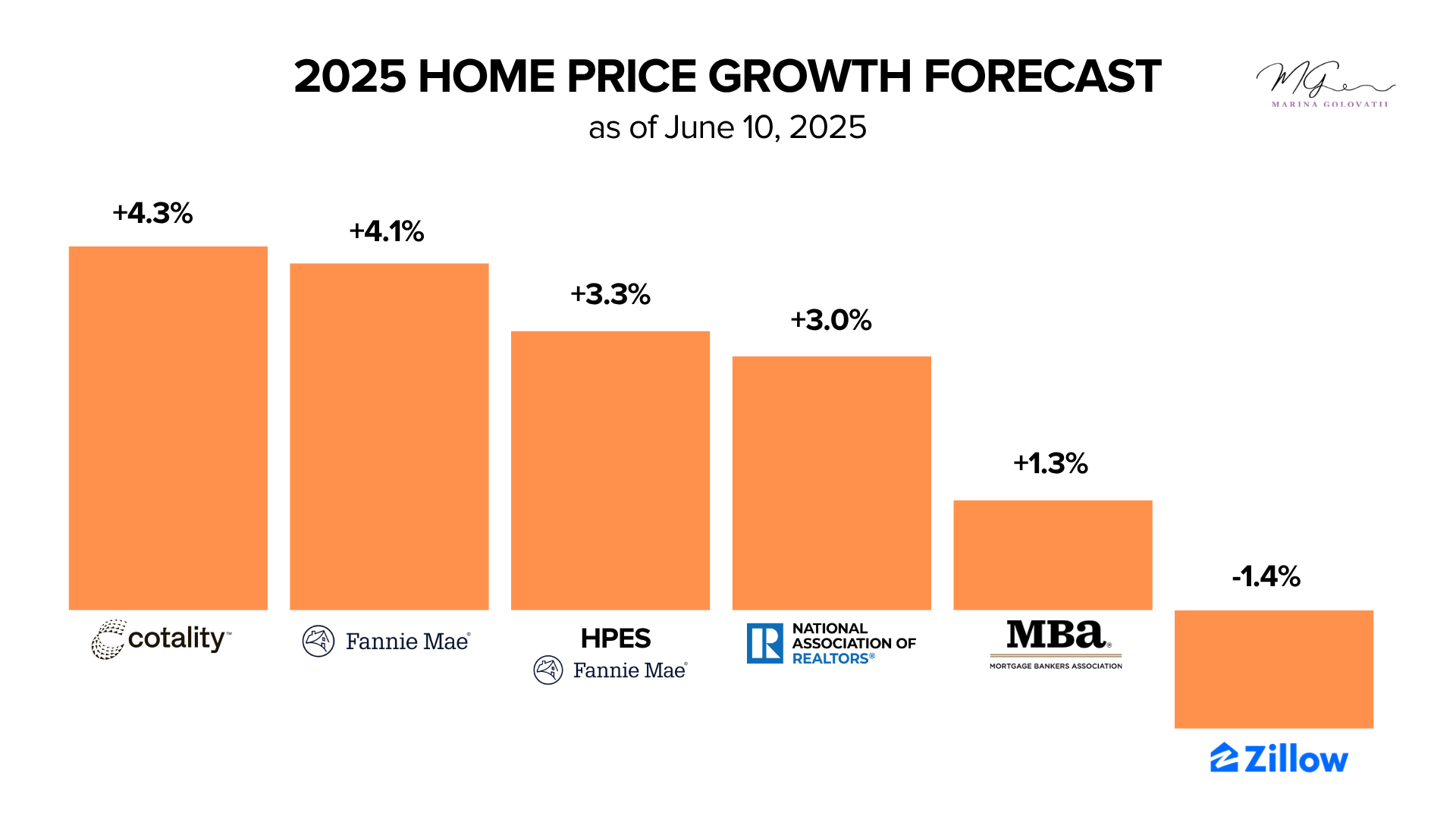

Home Price Forecasts

Most housing economists agree: prices will rise, but not by much. And depending on where you live, they could even decline.

Home price forecasts for 2025:

-

Cotality: +4.3% from April 2025 to April 2026

-

Fannie Mae: +4.1% in 2025

-

Home Price Expectations Survey (HPES): +3.3%

-

NAR: +3% in 2025, +4% in 2026

-

MBA: +1.3% in 2025, <1% in 2026

-

Zillow: -1.4%, an improvement from its earlier prediction of -1.9%

Notably, some overheated markets like Florida, Texas, Hawaii, and Washington D.C. are seeing declines.

Meanwhile, more affordable areas in the Midwest and Northeast are holding strong, especially suburbs near expensive cities.

❗Comparing 2025 to 2024 through May, the average sale price has increased 4.6% from $589,700 to $617,100. In the same comparison, the median sale price has increased 3.2% from $527,000 to $544,000.

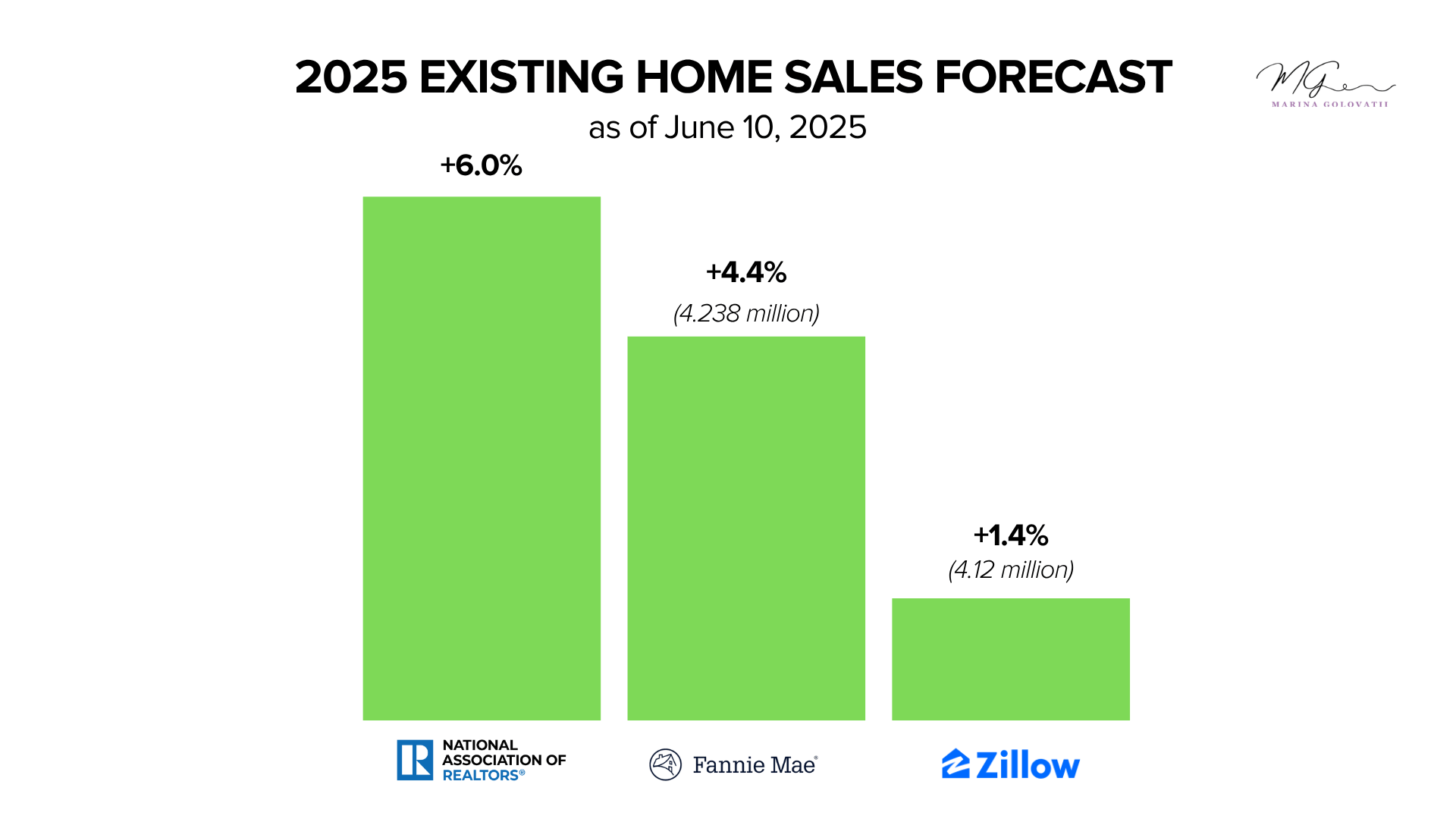

Existing Home Sales Outlook

Sales activity is expected to grow this year, but recovery will be gradual.

Forecasts for existing home sales in 2025:

-

NAR: +6% (with an 11% gain expected in 2026)

-

Fannie Mae: +4.4% (4.24 million home sales)

-

MBA: 4.3 million home sales

-

Zillow: +1.4% (4.12 million home sales)

Improving inventory and gradual rate relief are creating more movement in many markets.

❗In SouthWest WA we are seeng more homes getting on the market (New listings (986) increased 4.6% from the 943 listed in May 2024, and increased 10.9% from the 889 listed in April 2025) with shorter time to sell (Inventory increased to 3.4 months in May. Total market time decreased to 50 days), which means that homes that are priced correctly are selling fast and there are buyers looking for the right home.

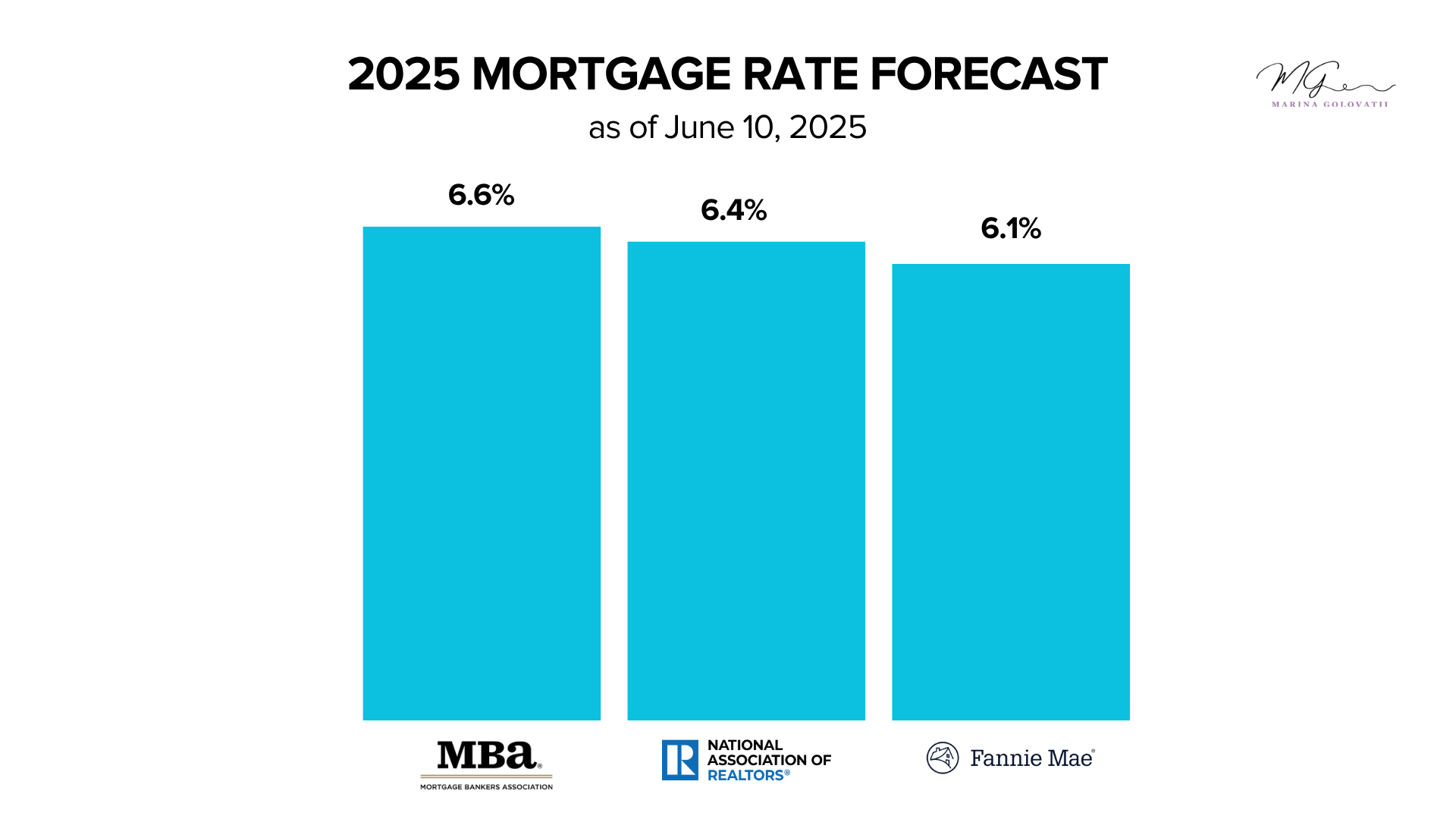

Mortgage Rate Predictions

If you're waiting for mortgage rates to drop below 5%, you’ll likely be waiting a while. But slow, steady improvement is expected.

2025 mortgage rate forecasts:

-

MBA: 6.6% average in Q4 2025; down to 6.3% by end of 2026

-

NAR: 6.4% in late 2025; 6.1% in 2026

-

Fannie Mae: 6.1% by year-end; 5.8% in 2026

Lawrence Yun, NAR’s Chief Economist, calls mortgage rates the “magic bullet” for unlocking market momentum. Lower rates could encourage more buyers, especially first-timers, back into the market.

❗In Clarck County WA we see buyers getting creative. They are looking into new homes, utilizing builders incentives to buy down the rates.

What This Means for You

Here’s the bottom line for buyers, sellers, and homeowners in today’s market.

Recovery is happening, but slowly. Most forecasts point to modest gains in both home prices and sales volume through the rest of 2025, with more growth expected in 2026.

Mortgage rates are likely to stay above 6%, which means realistic budgeting will remain essential for anyone looking to purchase.

But it’s important to remember that national trends only tell part of the story. Every local market behaves differently, and what’s happening in one region may not apply in another. Even different price points within the same market can experience completely different dynamics!

If you're curious about how these trends are playing out in Vancouver WA and surroundings, let’s talk. I'm happy to break down what’s happening and how it could impact your plans to buy or sell.

Recent Posts